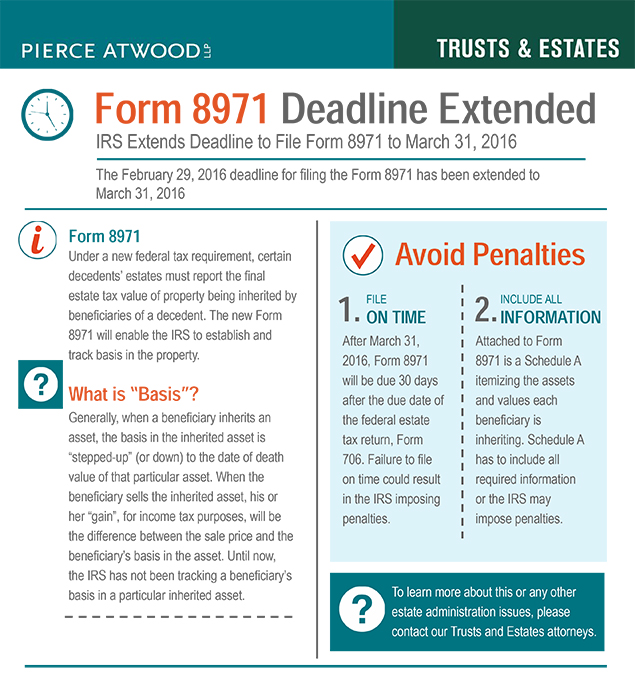

IRS Extends Deadline to File Form 8971

Under a new federal tax requirement, certain decedents’ estates must report the final estate tax value of property being inherited by beneficiaries of a decedent. The new Form 8971 will enable the IRS to establish and track basis in the property.

What is “Basis”?

Generally, when a beneficiary inherits an asset, the basis in the inherited asset is “stepped-up” (or down) to the date of death value of that particular asset. When the beneficiary sells the inherited asset, his or her “gain”, for income tax purposes, will be the difference between the sale price and the beneficiary’s basis in the asset. Until now, the IRS has not been tracking a beneficiary’s basis in a particular inherited asset.

Avoid Penalties

- FILE ON TIME

After March 31, 2016, Form 8971 will be due 30 days after the due date of the federal estate tax return, Form 706. Failure to file on time could result in the IRS imposing penalties. - INCLUDE ALL INFORMATION

Attached to Form 8971 is a Schedule A itemizing the assets and values each beneficiary is inheriting. Schedule A has to include all required information or the IRS may impose penalties.