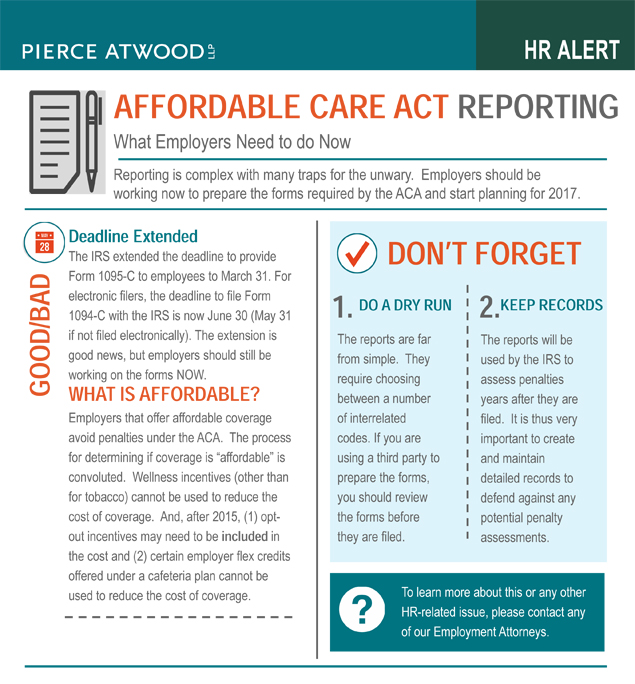

Affordable Care Act Reporting Requirements

Affordable Care Act Reporting: What Employers Need to do Now

Reporting is complex with many traps for the unwary. Employers should be working now to prepare the forms required by the ACA and start planning for 2017.

Deadline Extended

The IRS extended the deadline to provide Form 1095-C to employees to March 31. For electronic filers, the deadline to file Form 1094-C with the IRS is now June 30 (May 31 if not filed electronically). The extension is good news, but employers should still be working on the forms NOW.

What is Affordable?

Employers that offer affordable coverage avoid penalties under the ACA. The process for determining if coverage is “affordable” is convoluted. Wellness incentives (other than for tobacco) cannot be used to reduce the cost of coverage. And, after 2015, (1) opt-out incentives may need to be included in the cost and (2) certain employer flex credits offered under a cafeteria plan cannot be used to reduce the cost of coverage.

DON’T FORGET

- DO A DRY RUN: The reports are far from simple. They require choosing between a number of interrelated codes. If you are using a third party to prepare the forms, you should review the forms before they are filed.

- KEEP RECORDS: The reports will be used by the IRS to assess penalties years after they are filed. It is thus very important to create and maintain detailed records to defend against any potential penalty assessments.

For questions on ACA reporting or for additional information on this or any other employment law-related issue, please contact any member of Pierce Atwood’s Employment Practice Group.