Splashdown for DOL Overtime Rules

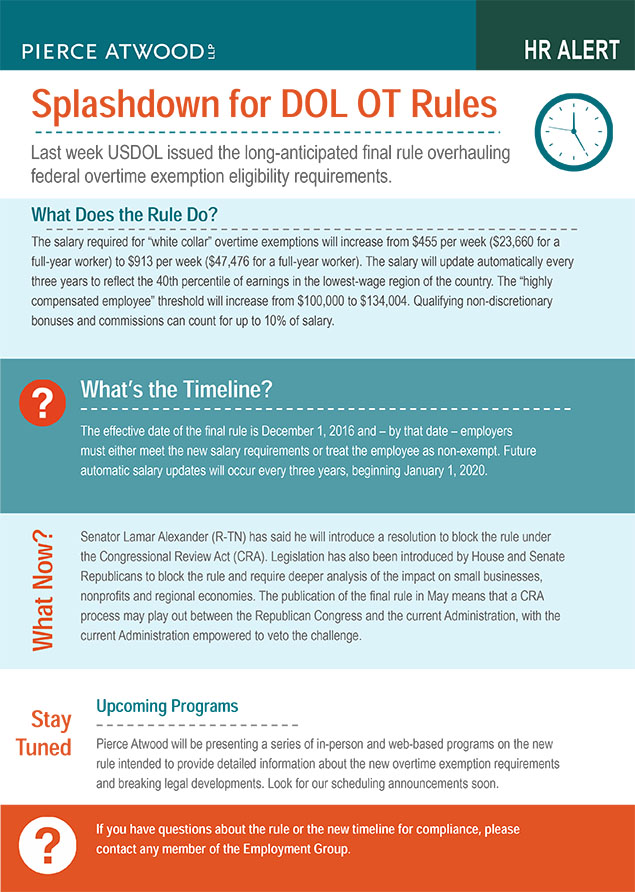

Splashdown for DOL OT Rules

The USDOL recently issued the long-anticipated final rule overhauling federal overtime exemption eligibility requirements.

What Does the Rule Do?

The salary required for “white collar” overtime exemptions will increase from $455 per week ($23,660 for a full-year worker) to $913 per week ($47,476 for a full-year worker). The salary will update automatically every three years to reflect the 40th percentile of earnings in the lowest-wage region of the country. The “highly compensated employee” threshold will increase from $100,000 to $134,004. Qualifying non-discretionary bonuses and commissions can count for up to 10% of salary.

What’s the Timeline?

The effective date of the final rule is December 1, 2016 and – by that date – employers must either meet the new salary requirements or treat the employee as non-exempt. Future automatic salary updates will occur every three years, beginning January 1, 2020.

What Now?

Senator Lamar Alexander (R-TN) has said he will introduce a resolution to block the rule under the Congressional Review Act (CRA). Legislation has also been introduced by House and Senate Republicans to block the rule and require deeper analysis of the impact on small businesses, nonprofits and regional economies. The publication of the final rule in May means that a CRA process may play out between the Republican Congress and the current Administration, with the current Administration empowered to veto the challenge.